1.1 Snapshot of German IT Landscape

Recent reports indicate that Germany, a powerhouse of industry and economy, deals with particular IT-related challenges, such as skill shortages. According to the Digital Economy and Society Index (DESI) 2022 [4], Germany ranks 18th in the European Union for digitalization progress in public services. This position indicates a slower digital transformation pace than other EU nations. According to the data from Lünendonk [7], the IT services market in Germany faces a substantial shortage of IT specialists that impedes the country’s growth potential. A recent report by Bitkom1, Germany’s largest digital association for developing IT markets, indicates that there is now a shortage of 137,000 IT specialists across all industries. Compared to the previous year, that is about a 150% increase.

1.2 Navigating The Gap

The shortage of digital and IT professionals has led to a scenario where project requests are not adequately served, and some are rejected. According to Lünendonk [7], around 15.3% of project requests were denied due to an insufficient number of skilled staff. Even with high demand from both companies and public administration, the growth dynamic within the IT services market is expected to remain high but not increase further. The challenge has a cascading effect. Notably, IT service providers are not only fighting for digital and IT experts; companies are increasingly seeking to cultivate in-house IT capabilities. Despite an increase in revenue, employee growth in 2021 was lower than initially projected — a clear indicator of difficulties in attracting new talent. Since 2015, Lünendonk has noted that every fifth vacancy at IT service providers remains unfilled.

1.3 Impact of Legacy Systems

The existence of monolithic legacy systems in the German landscape creates a significant difficulty. Due to this issue, it is challenging to incorporate modern innovations seamlessly. For example, some German companies still rely on legacy systems, like SAP R/3, COBOL applications, custom legacy applications, and core mainframe systems. These systems may need more flexibility to meet the demands of modern infrastructure and customer expectations. As a result, they are less able to adopt advanced digital technologies or implement new regulations swiftly.

German companies are turning to innovative solutions in response to the skill shortage. Establishing nearshore and offshore locations has become a strategic approach to address the scarcity of skilled workers. These locations provide access to a broader talent pool and allow companies to use the expertise from different regions.

The Central-Eastern European (CEE) region has become one of the popular destinations for IT outsourcing. It has emerged as a powerhouse, redefining the industry’s dynamics. As businesses seek innovation, scalability, and cost-effectiveness, the CEE region (such as Poland, Ukraine, and the Czech Republic) has become a hub for software development and IT outsourcing.

Just east of Germany lies Poland, a country with a compelling narrative in digitalization and innovation. In 2021, Poland’s IT sector surged from PLN 75 billion to PLN 89 billion, as reported by Computerworld TOP200[2]. This significant growth emphasizes Poland’s resilience to economic instability. These numbers give businesses a clear message that digitalization and IT tools are crucial to maintaining a competitive edge.

As we examine Poland’s IT potential, we’ll discover how it can be valuable for Germany’s digitalization endeavors.

2.1 Poland’s IT Market Landscape

According to the Emerging Europe report[9], Poland’s IT industry ranks third most competitive among 23 Central and Eastern European nations, following only Estonia and Lithuania. Impressively, Poland secured places in the top four in 11 categories out of 45, with a significant win in the staff training and development category.

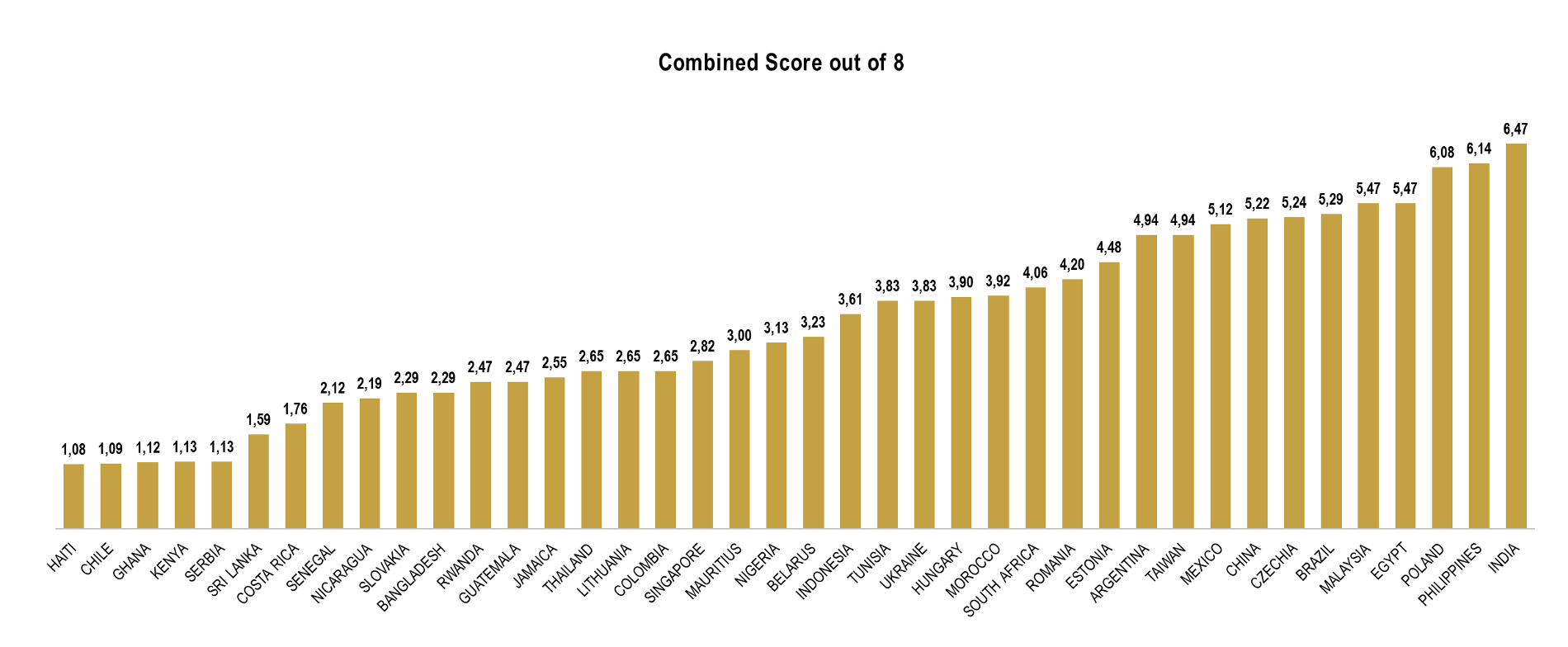

To prove Poland’s IT expertise, in 2022, GBS World[5] ranked Poland, along with the Philippines, as the second-most desirable location for outsourcing IT services. India held the top position, and Egypt ranked third.

General ITO Services

Source: GBS World

Notably, Poland also claimed first among nations preferred for outsourcing technical support.

Poland’s IT services and market remain on an upward trajectory, primarily driven by its skilled workforce. As of 2022, the Eurostat data [8] indicates that approximately 600,000 IT professionals actively contribute to the country’s IT landscape, and this number continues to rise. Polish educational institutions deserve credit for nurturing this growth by emphasizing technology-focused curricula and fostering research and development.

Technical and Helpdesk Support

Source: GBS World

Polish developers who work in the IT industry are familiar with all current programming languages. According to the market analyses [6], the most popular programming languages are PHP, Microsoft Asp.NET, Lua, Python, and Node.js. This aligns with global trends and highlights the country’s focus on server-side apps, AI, and web development.

2.2 Educational Potential and Language

Poland’s commitment to IT-related education has cultivated a vast pool of skilled IT experts. The Eurostat data indicates that, in Poland, there is a substantial number of ICT graduates and qualified IT professionals, and it is consistently growing, making it an enticing choice for businesses seeking external IT support. According to GBS, 44% of Polish workers hold post-secondary qualifications.

Most Polish IT professionals are not only fluent in English, but also proficient in other significant European languages. Having such skills facilitates effective communication. In 2022, the EF English Proficiency Index (EF EPI) [3] ranked Poland 13th for its English competence among European countries.

2.3 Favorable Locations and Rates

One of the primary reasons why Poland is favored for outsourcing is its competitive labor costs. The average hourly rates for skilled professionals, such as software developers and customer service representatives, are significantly lower than in Western European countries and the United States.

In general, outsourcing rates in Poland are notably lower than in Germany, which is known for its high labor costs. Businesses outsourcing to Poland can achieve substantial cost savings that can result even in a 50% cost reduction.

On the other hand, looking at the world scale, you can find more competitive rates regarding IT outsourcing. Therefore, finding quality services is the foundation of long-term trustful IT cooperation and successful project implementation.

Would you like to know the rates of a polish IT provider? Contact us: sales@craftware.com

After analyzing IT outsourcing and Polish-German collaboration, it becomes clear that Polish IT expertise can be a dynamic and innovative solution to the challenges faced by the German IT landscape.

Germany’s digitalization journey, while impressive, has encountered difficulties in the form of skill shortages and legacy systems. However, these challenges should not be viewed as roadblocks but rather as opportunities to benefit from the strengths of Poland’s thriving IT sector.

Poland’s remarkable journey in digitalization and innovation, exemplified by substantial growth in its IT sector, makes it a strategic partner for Germany. Poland’s resilience to economic instability emphasizes the country’s vital role in maintaining competitiveness through digitalization and modern IT tools.

Furthermore, as proved by top rankings in numerous categories, Poland’s excellence in staff training and development ensures that businesses partnering with Polish IT experts can expect world-class capabilities and continuous improvement.

In conclusion, the collaboration between Germany and Poland in the area of IT outsourcing is not just a solution to existing challenges; it’s a strategic move towards unlocking new opportunities for digital transformation. By taking advantage of Poland’s IT potential, Germany can accelerate its digitalization efforts and bridge the skill gap while growing its business resilience.

Join Craftware and Wirtschaftsclub for a business lunch event in Düsseldorf on November 16. We will discuss the innovation, resilience and cost-effectiveness of partnerships with external IT partners.

📅16.11.2023 [9:00]

📌Business Club, Düsseldorf

- Alphacoders. (August 22, 2023). Shortage of IT specialists: The cost of an unfilled position. https://www.alphacoders.de/insights-en/shortage-of-it-specialists-the-cost-of-an-unfilled-position

- Computerworld. (June 21, 2021). Computerworld TOP200: Polski Rynek Teleinformatyczny. https://www.computerworld.pl/news/Premiera-TOP200-2021,428975.html

- EF Education First. (2022). EF English Proficiency Index. https://www.ef.edu/epi/regions/europe/poland/

- European Commission. (July 28, 2022). Digital Economy and Society Index (DESI) 2022. https://digital-strategy.ec.europa.eu/en/library/digital-economy-and-society-index-desi-2022

- GBS World. (September 20, 2022). Competitiveness Index for Digital and ITO Services. https://gbs.world/blog/2022/09/20/gbs-world-competitiveness-index-for-digital-and-ito-services/

- Host Advice. (2023). Poland Programming Language Market Share September 2023. https://hostadvice.com/marketshare/language/pl/

- Lünendonk. (2023). Lists & Rankings. https://www.luenendonk.de/en/products/lists/

- Eurostat. (2023). Data Browser. https://ec.europa.eu/eurostat/databrowser/view/isoc_sks_itspt/default/table?lang=en

- Tech Emerging Europe Advocates. (2023). Future of IT Report: The ultimate guide for IT buyers, investors and experts. https://d1aettbyeyfilo.cloudfront.net/emergingeurope/30982500_1680870213929FUTURE_OF_IT_REPORT_2023.pdf